22 December 2022

22-12-2022

12:00:AM

948 Views

Table of Content

|

What are carbon markets and how do they operate?

GS-3: Conservation, Environmental Pollution and Degradation, Environmental Impact Assessment.

Recently, the parliament has passed the Energy Conservation (Amendment) Bill, 2022 to empower the Government to establish carbon markets in India and specify a carbon credit trading scheme.

Carbon Markets

- Carbon markets are trading system of carbon credits, where carbon credits or allowances can be bought or sold.

- Thus, it is a tool for imposing monetary value on carbon emissions.

- A carbon credit is a permit that allows a country or organization to produce a certain amount of carbon emissions and can be traded if the full allowance is not used.

- It equals one ton of carbon dioxide removed, reduced, or sequestered from the atmosphere.

- These carbon allowances are decided by countries according to their emission reduction targets.

Nationally Determined Contributions (NDCs)

- Under Paris Agreement (2015), nearly 170 countries have submitted their NDCs in order to keep global warming within 2°C (Ideally 1.5°C).

- For this, Global Greenhouse Gas (GHG) emissions need to be reduced by 25 to 50% over this decade.

- NDCs are voluntarily committed climate targets by countries to achieve net-zero emissions.

- India set to achieve net-zero target by 2070 whereas major developed countries have set to achieve net-zero target by 2050.

- Article 6 of the Paris Agreement provides for the use of international carbon markets by countries to fulfil their NDCs.

- Thus, Carbon markets became popular tool as a mitigation strategy among countries in order to meet their NDCs.

- As per a United Nations Development Program release, around 83% of NDCs submitted by countries have intent to use of international market mechanisms to reduce greenhouse gas emissions.

Types of Carbon Markets

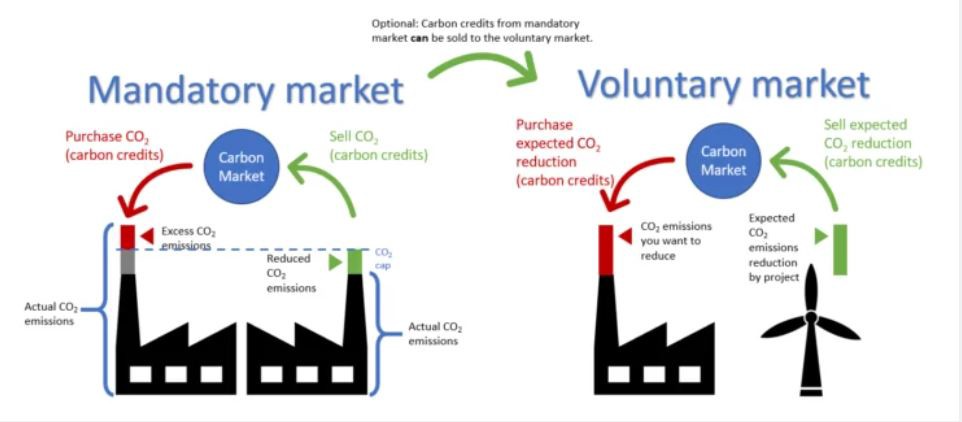

- At present, there are two types of carbon markets – voluntary markets and compliance markets.

Voluntarily Markets

- In voluntary markets, emitters such as corporations, private individuals etc. buy carbon credits to offset the emission of one ton of CO 2 or equivalent greenhouse gases.

- Such carbon credits are generated by activities such as afforestation to reduce CO2 from the air.

- A corporation looks to offset its unavoidable GHG emissions in a voluntary market by purchasing carbon credits from an entity engaged in projects that reduce, remove, capture, or avoid emissions.

- For example, Airlines may purchase carbon credits to compensate carbon footprint generated by their flight Credit are verified by private firms based on popular standards in the voluntary markets.

- Certified credits can be bought using online registries where climate projects are listed.

Compliance market

- It is regulated by the government and is set up by a policy at the national, regional, and/or international level.

- Based on popular European Union Model, it operates under a principle called ‘cap-and-trade’.

EU’s emissions trading system (ETS):

- Launched in 2005.

- Cap: Member countries set a limit for emissions in different sectors such as power, agriculture etc.

- The cap is determined as the climate targets of countries.

- It is lowered successively to reduce emissions.

- Trade: If companies produce emissions beyond the capped amount, they have to purchase additional permit.

- They can purchase additional permit either through official auctions or from companies having surplus allowances.

- Market price of carbon: Determined by the market forces.

- Companies can also save up excess permits to use later.

Benefits of carbon markets

- Provides liberty to companies to decide whether it is more cost-efficient to employ clean energy technologies or to purchase additional allowances.

- Promotes the reduction of energy use

- Encourages the shift to cleaner fuels

- Government regulated trading schemes provide a clear trajectory relating to carbon emission norms and prompt companies to innovate, invest in, and adopt cost-efficient low-carbon technologies.

- According to World Bank estimates, trading in carbon credits could reduce the cost of implementing NDCs by more than half (Approx. $250 billion by 2030).

Challenges to carbon markets

- Double counting of greenhouse gas reductions.

- Quality and authenticity of climate projects.

- Lack of transparency in the institutional and financial infrastructure for carbon market transactions.

- Greenwashing – Companies offset carbon footprints instead of reducing their overall emissions or investing in clean technologies.

- ETSs may not automatically reinforce climate mitigation instruments for regulated markets.

- High emission-generating sectors under trading schemes offset their emissions by buying allowances, which may increase emissions on net and provide no automatic mechanism for prioritizing cost-effective projects in the offsetting sector.

- Emission reductions and removals are either not real or not aligned with the country’s NDCs.

Energy Conservation (Amendment) Bill, 2022 and carbon markets in India

- The bill empowers the union government or an authorized agency to issue carbon credit certificates to companies or even individuals registered and compliant with the scheme.

- These carbon credit certificates will be tradeable in nature and can be bought by a person on a voluntary basis.

- Concerns:

- The bill was tabled by the power ministry instead of the Ministry of Environment, Forest, and Climate Change (MoEFCC).

- There is a lack of clarity on –

- Regulating agency

- Mechanism to be used – like the cap-and-trade schemes or another method

- Interchangeability – Whether certificates under already existing schemes would also be interchangeable with carbon credit certificates and tradeable for reducing carbon emissions.

- Types of tradeable certificates are issued in India – 1) Renewable Energy Certificates (RECs) and 2) Energy Savings Certificates (ESCs).

Carbon markets around the world

- Carbon markets either operate or are under development in North America, Australia, Japan, South Korea, Switzerland, and New Zealand.

- China also launched the world’s largest ETS in 2021 approx. covering one-seventh of the global carbon emissions from the burning of fossil fuels.

Inter-country carbon market

- Art 6 of the Paris Agreement provides for the U.N. international carbon market.

- This provision is yet to kick off as multilateral discussions are still underway regrading its functioning across world.

- Under proposed market, Countries would be able to offset their emissions by buying credits generated by greenhouse gas-reducing projects in other countries.

- In the past, Clean Development Mechanism (CDM) had allowed inter-country carbon markets. But the scenario changed with the 2015 Paris Agreement, which forced even developing countries to set emission reduction targets.

Kyoto Protocal and Clean Development Mechanism (CDM)

- Annex-B of the Kyoto protocol sets binding emission reduction targets for 37 industrialized countries and economies in transition and the European Union.

- Whereas India and other developing nations such as China, Brazil, etc. were exempted from legally binding commitments on greenhouse gas emissions.

- Thus, India and other developing countries have gained significantly from a similar carbon market under the CDM of the Kyoto Protocol, 1997.

- India registered 1,703 projects under the CDM which is the second highest in the world.

Fact File

US-Canada Great Lakes turning acidic: Study seeks to establish details

Great lakes

|

Comments

Login To Comment

Recent Comments